Exploring the dispute management interface

The Disputes menu allows you to manage dispute cases and to follow Lyra Collect’s efforts in preventing and disputing chargebacks in real time.

A chargeback occurs when a successful transaction is disputed by the end customer via their bank. This dispute can occur days or months after the transaction, up to 390 days.

In this interface, you will find the means to process/dispute chargebacks, prove the order authenticity and the payer’s identity via supporting documents.

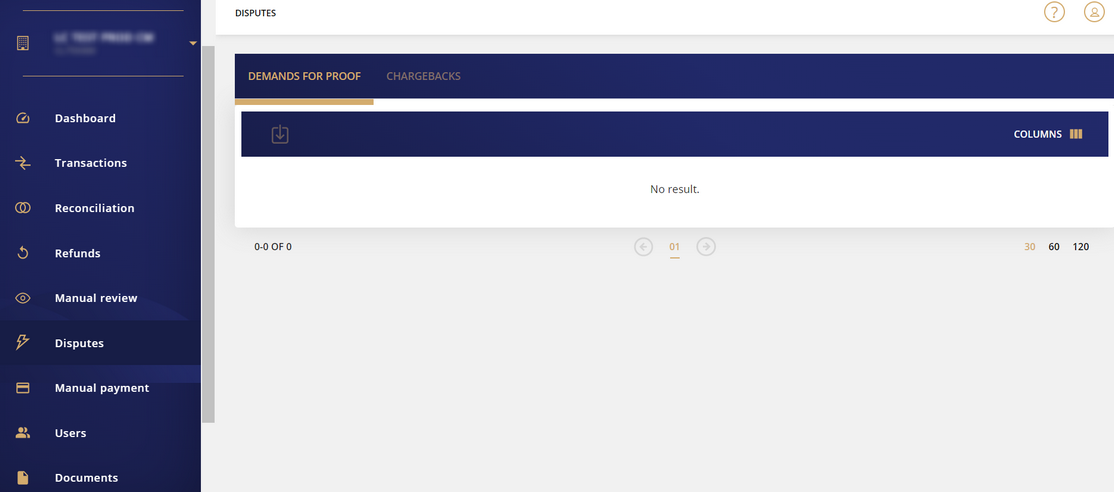

- An interface for tracking requests for supporting documents

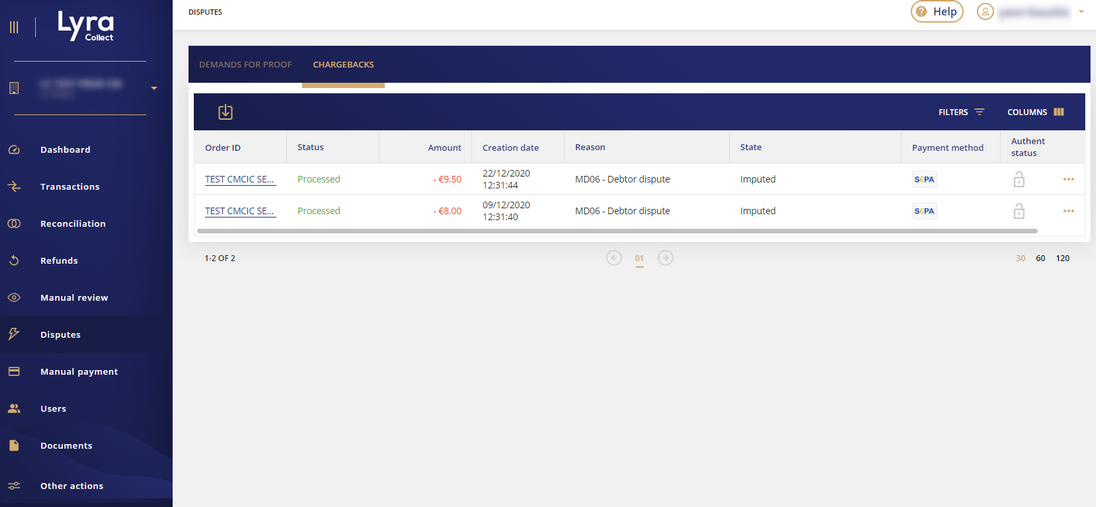

- An interface for tracking chargebacks

Requests for supporting documents

| Column title | Description |

|---|---|

| Activity | In view of improving the follow-up of your requests, this information allows us to identify which activity (store, for example) the order number to be processed belongs to. |

| Order ID | This is the order number concerned by the dispute. The number is interactive. When you click on the number, the dispute tracking page is displayed with all the details about it (exchanged messages and receipts). You will also be able to follow and/or continue the exchanges concerning the dispute. If a refund is possible, you can trigger it by clicking the Refund button. |

| Status | Refers to the status of the dispute. The different possible statuses are:

|

| Remaining days count | Refers to the count of the day(s) remaining in the dispute period. The regulatory period is set at 6 days. If the merchant does not respond within the allocated time, the chargeback process is triggered. |

| Amount | Refers to the amount of the dispute. |

| Initial transaction | This field indicates the date and time of the original transaction. |

| Reason | Indicates the reason for the dispute. Examples: Request following a dispute, cardholder’s request |

| Icon | Action | Description |

|---|---|---|

| Export | Allows you to export the list of transactions in CSV format (compatible with Microsoft Excel). |

| Customize Columns display | Allows you to select the columns to display for completing your data analysis. By default, the Back Office displays the data deemed most relevant, but you can enable/disable certain columns. |

Chargebacks

| Column name | Description | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| Order ID | This is the order number concerned by the dispute. The number is interactive. When you click on it, the dispute tracking page is displayed with all the details about it. You will also be able to access the Challenge button if the dispute can be challenged. Click on Actions > Challenge. | ||||||||

| Status | Refers to the chargeback status. The different possible statuses are:

| ||||||||

| Amount | Refers to the chargeback amount. | ||||||||

| Creation date | This field indicates the date and time when the chargeback was created. This information can be completed by displaying the column Date of last update. | ||||||||

| Reason | Indicates the reason for the chargeback. The reason can be identified via an international code and label defined by the card issuers. Example: 21 - Expired card 14 - Transaction not authorized by the issuer | ||||||||

| Status | Indicates the chargeback status. Examples of statuses:

| ||||||||

| Authentication status | Authentication statuses provide information about the initial transaction. A logo is present on each order. A tooltip provides information on the transaction status. Example:

| ||||||||

| Payment method | Displays the payment method logo used for the transaction This information can be completed by displaying the column entitled Product code of the payment method. |

| Icon | Action | Description |

|---|---|---|

| Context menu for challenging a chargeback | This icon is displayed to the right of each chargeback line. Once you click on it, the Challenge button will appear. The menu is active when a challenge is not already in progress on the selected line. |

| Challenge button | When you click on the Challenge button, a window appears where you can write a challenge comment and attach supporting documents. |

| Export | Allows you to export the list of chargebacks in CSV format (compatible with Microsoft Excel). |

| Filters | Allows you to display the search window via predefined filters (amount, creation dates, etc.). |

| Customize Columns display. | Allows you to select the columns to be displayed for analyzing the chargeback table. By default, the Back Office displays the data deemed most relevant, but you can enable/disable certain columns. |